March 2020 – Never to be Forgotten

Wow! What a time to be alive! I don’t think we will ever forget March 2020. And definitely not the last few weeks of March 2020. Each day seems to bring a new curveball for us all to deal with. Make no mistake, we are living through a moment in time that will be recorded in the history books for ever more. Let’s all make sure we do our bit to keep our fellow citizens safe and healthy.

Positive Days in the Stock Market

And then there’s the stock markets. On Tuesday last the S & P 500 (the top 500 companies in the US), went up in value by 9.38%. It was the largest single day return since October 2008. This occurred in the midst of the lockdown measures being announced in Ireland and the UK. And of course, it came hot on the heels of a -30%+ decline over the previous couple of weeks. Wednesday saw another modest increase and Thursday saw a gain of almost 5%. The week ended on a bit of a whimper with a loss of a little over 2%.

Here’s the thing …

Nobody predicted a near 10% return on Tuesday. Absolutely nobody. But if you miss that day, your investment portfolio or pension fund is going to struggle to get what the market will deliver over the long term. If you miss Tuesday, Wednesday and Thursday, then you have big, big problems. Now you’re going to get the “investor” return and not the “market” return. For avoidance of doubt, the “investor” always gets less than the “market”. For more on this subject, have a read of this:

You’re making big finanical mistakes – and it’s your brain’s fault

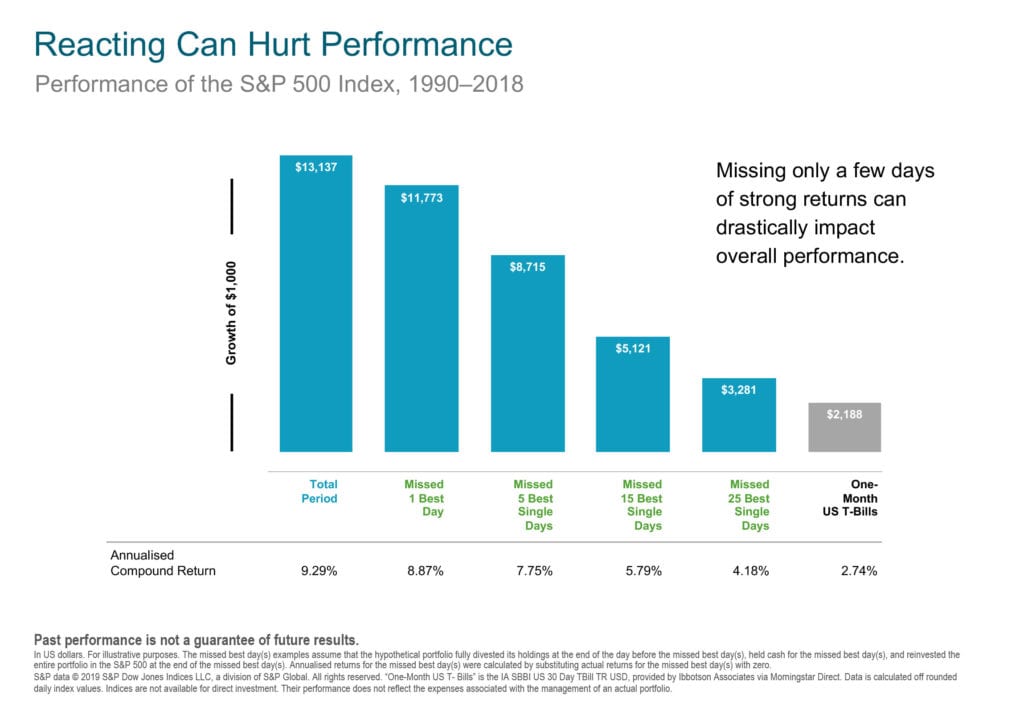

Stay Invested and Don’t Miss the Best Days

Dimensional Fund Advisors did a study in early 2019 and reviewed a portfolio from 1990 to 2018. So, a very long period of time and a typical investment period for the clients of Metis Ireland. And they found that missing the best day over that length of time has a huge impact on your investment performance. Now, roll it on and if you miss the best 25 days, the impact is colossal. Nobody knows when these “best days” are going to come. But they often come in clusters and they often come very soon after the “bad days”.

Are Stock Market predictions useful?

Did you see Covid 19 in many 2020 stock market predictions? Nope, because nobody could have predicted it. So, once and for all, can we all agree to ditch the guesswork and do something useful with our time. Those January predictions are not worth the paper they are written on. Predicting stock market trends is not possible. The fall of the “star” fund managers in 2019 proved this point. I’m sure the investors with these star fund managers wish they didn’t listen to their predictions.

How long will it take to recover?

I have no idea. Nor does anyone else. For guidance, I would recommend that you look at the evidence from previous steep temporary declines in the stock market. This helps us to avoid emotional (and costly) money decisions and should give us all some context for the immediate future. Here’s an article from the brilliant Ben Carlson (find him on Twitter @awealthofcs) that does the homework for us:

How Long Does it Take to Make Your Money Back After a Bear Market

If you don’t have time to read the article, history tells us the average period of time to get back to break even is just over two years. Of course, there are much longer and much shorter examples.

The long and the short of it …

Stay invested or as we say in Metis Ireland:

#StickWithThePlan

We know that’s very easy to say but much harder to do. It feels like we should all be doing something now. That intuition will cost you money. Resist it and don’t listen to anyone who tells you they know what is going to happen.

Think about your investment and pension portfolio like a bar of soap … The more you touch it, the less it becomes.

We are here, ready willing and able to help you through this uncertain time. Let us do the money bit for you and you go and keep yourself and your family safe.

Carl Widger

Managing Director

Email: info@metisireland.ie

Phone: Limerick 061 518365

Dublin 01 9081500

Twitter: @metisireland

Disclaimer

Metis Ireland Financial Planning Ltd t/a Metis Ireland is regulated by the Central Bank of Ireland.

All content provided in these blog posts is intended for information purposes only and should not be interpreted as financial advice. You should always engage the services of a fully qualified financial adviser before entering any financial contract. Metis Ireland Financial Planning Ltd t/a Metis Ireland will not be held responsible for any actions taken as a result of reading these blog posts.