How to extract cash from a Family Limited Company using PRSAs

In the last two years there has been significant changes to pension legislation that are hugely beneficial to business owner. Firstly PRSAs are now one of the most tax-efficient tools for extracting money from your business as you can make unlimited Employer pension contributions to a PRSA for an employee of your company. Secondly the pension fund threshold is going to increase gradually over the next few years until it reaches €2.8mil in 2029.

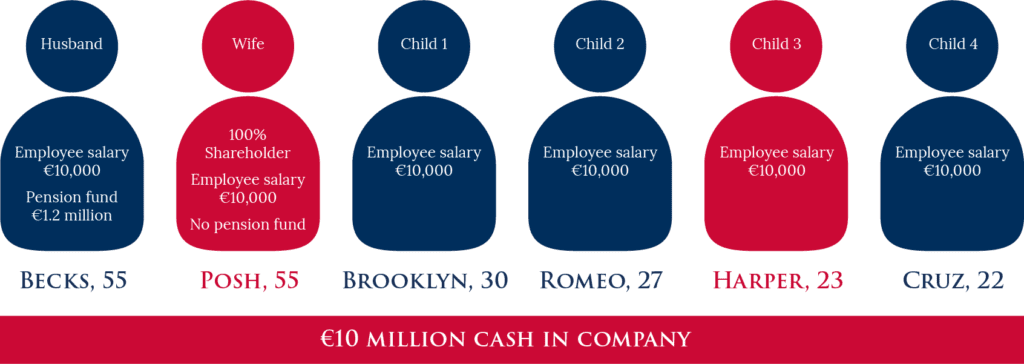

We met a family in 2023 that had recently had a payout of €10million cash into their family owned company. They wanted to know what options they had in relation to extracting cash and making sure their wealth was not being eroded by inflation.

Their current situation

Clearly, we’re not going to be using their real names here. So, bear with us while we draw on celebrity names. Here’s the family in question:

Posh and Becks have previously sold a company and used up their entrepreneurs’ relief allowance. They have sufficient personal wealth to fund their lifestyle, so they don’t want to extract cash from the company and pay too much tax.

Now that PRSAs can accept BIK-free employer contributions, several opportunities have arisen for this family.

The solution

Step 1

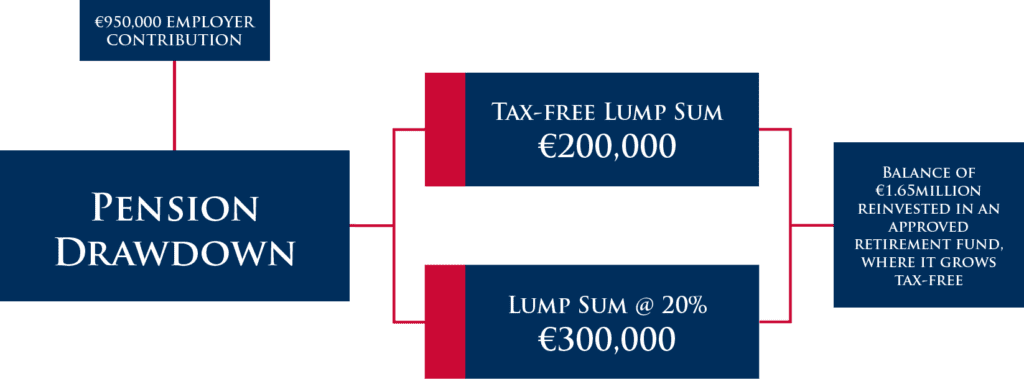

The company makes a €950k employer contribution to Becks’ pension. This brings him to the maximum pension fund of €2.15million.

As he is in his 50s, he can decide to retire from the company and draw down his pension as follows:

Alternatively he can decide to leave his PRSA intact and let the it grow until it reaches €2.8mil.

Step 2

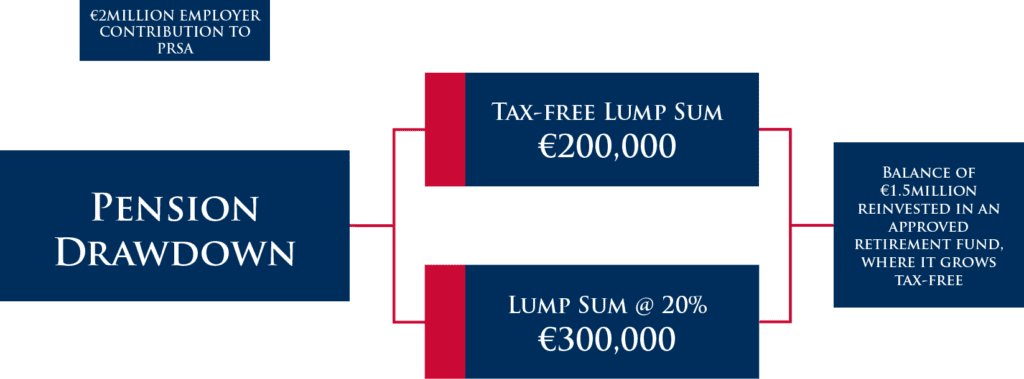

Posh has never had any pension funding other than a small teacher’s pension. This is currently valued at around €150,000.

The company can make a €2million pension contribution into a new PRSA for her.

Posh has just turned 55, so she can retire from the company and draw down her PRSA. She does not have to sell her shares to draw down her PRSA. She can also decide to defer the drawdown of her PRSA and let is grow to €2.8mil

Step 3

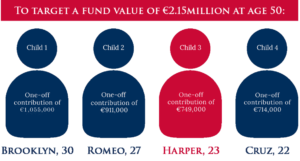

Since each of their children are employees in the company, they too can receive unlimited BIK employer pension contributions to a PRSA.

Based on their ages, we were able to work how much they need to contribute now so they could target the maximum pension fund at age 50, which is the earliest they would be able to draw it down on leaving the company.

We assumed a net 5% growth rate per annum due to the long-term nature of the investment:

Total wealth extraction to pension where funds can be invested and compound tax free = €6,379,000.

We’re currently working with this family’s tax advisors, as there may be some other reliefs and options available for the balance of cash in the company over the coming years.

The result

PRSAs are now one of the most efficient tools for extracting wealth from your company in a tax-efficient manner. They have never been simpler and easier to use as a means of tax planning for your company.

Had we sat down with the same family in 2022, before the changes to PRSAs, we wouldn’t have been able to extract more than 10% of the €6.3 million we have managed to extract now from the company. The previous rules were far more stringent and less flexible.

*Warning it now appears that further restrictions will be added to PRSA due to the recent Finance Bill, this will limit Employer contributions from 2025 onwards to 100% of employees salaries.

What next?

Before making any decisions, we always strongly recommend that you seek advice from a qualified, experienced professional.

This could be:

-

- • Whoever does your business accounts

-

- • An independent tax advisor

- • A pensions and financial planning expert, such as Metis Ireland

If you’d like to discuss your situation and your plans for your pension fund, please don’t hesitate to give us a call on 01 908 1500 or email us at info@metisireland.ie.

Cian Callaghan

Private Client Manager

Disclaimer: All figures are correct until 31st December 2024. Metis Ireland is not a tax advisor. All content in these blog posts is intended for information purposes only. We recommend that you should always seek independent tax advice.

Disclaimer

Metis Ireland Financial Planning Ltd t/a Metis Ireland is regulated by the Central Bank of Ireland.

All content provided in these blog posts is intended for information purposes only and should not be interpreted as financial advice. You should always engage the services of a fully qualified financial adviser before entering any financial contract. Metis Ireland Financial Planning Ltd t/a Metis Ireland will not be held responsible for any actions taken as a result of reading these blog posts.